Main developments

In recent months, inflationary pressure has sharply declined due to falling energy prices. Nevertheless, high inflation continues to persist. One of the main reasons for this are rising prices of groceries, in particular food.

The cost of groceries continues to rise due to higher costs for producers and suppliers. This is partly because companies are still feeling the impact of high energy prices from a year ago. Another reason is that wages have significantly increased due to high inflation. Rising wages, in turn, lead to new price pressures, which is one of the reasons why core inflation is expected to remain high. As a result, the ECB will continue its contractionary monetary policy.

High prices of everyday products continue to play a vital role in consumers’ lives and thus affect their sentiment. As a result, consumer sentiment remained negative. In contrast, certain underlying factors such as opinions on the financial and economic situation for the next 12 months have improved.

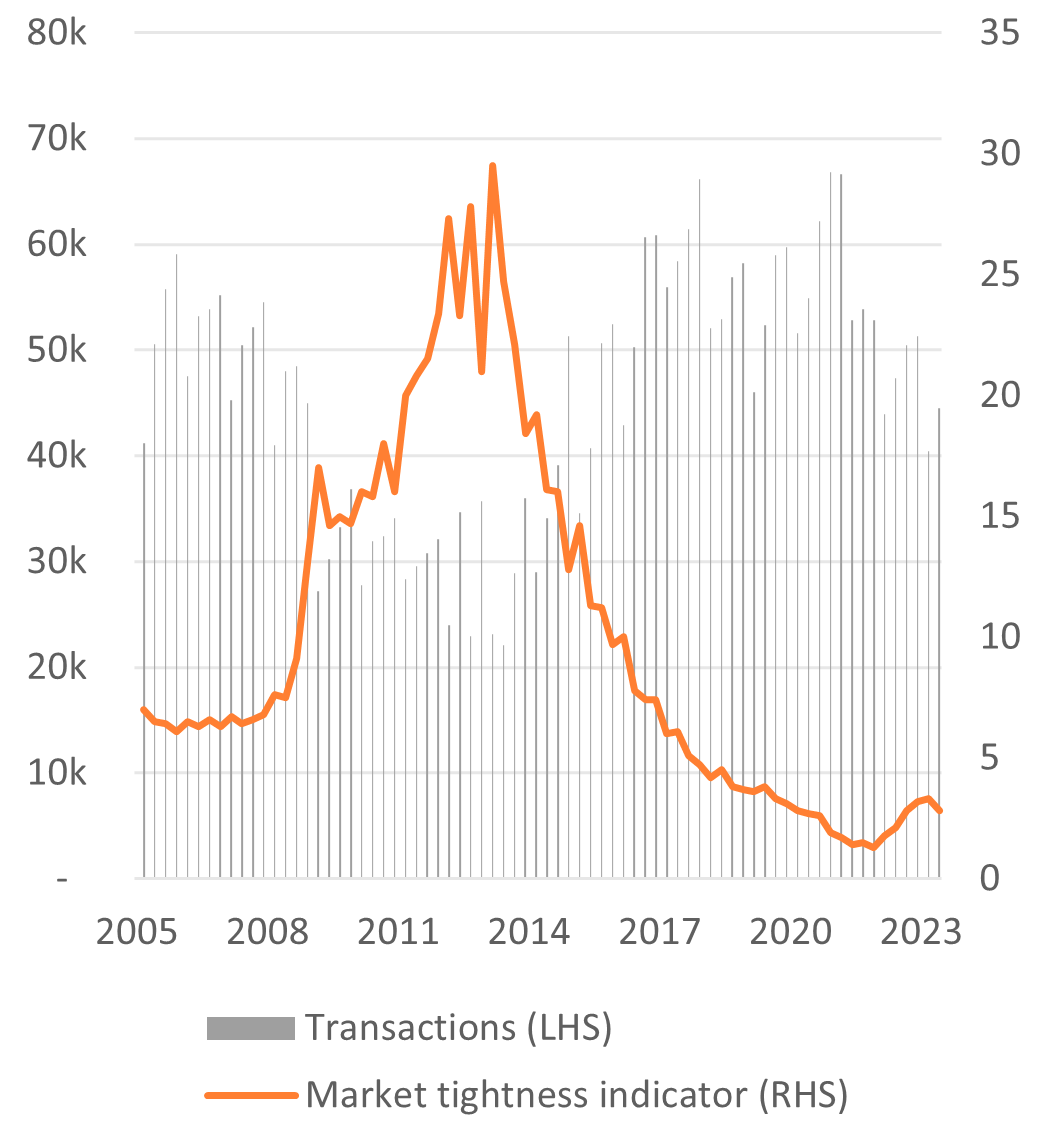

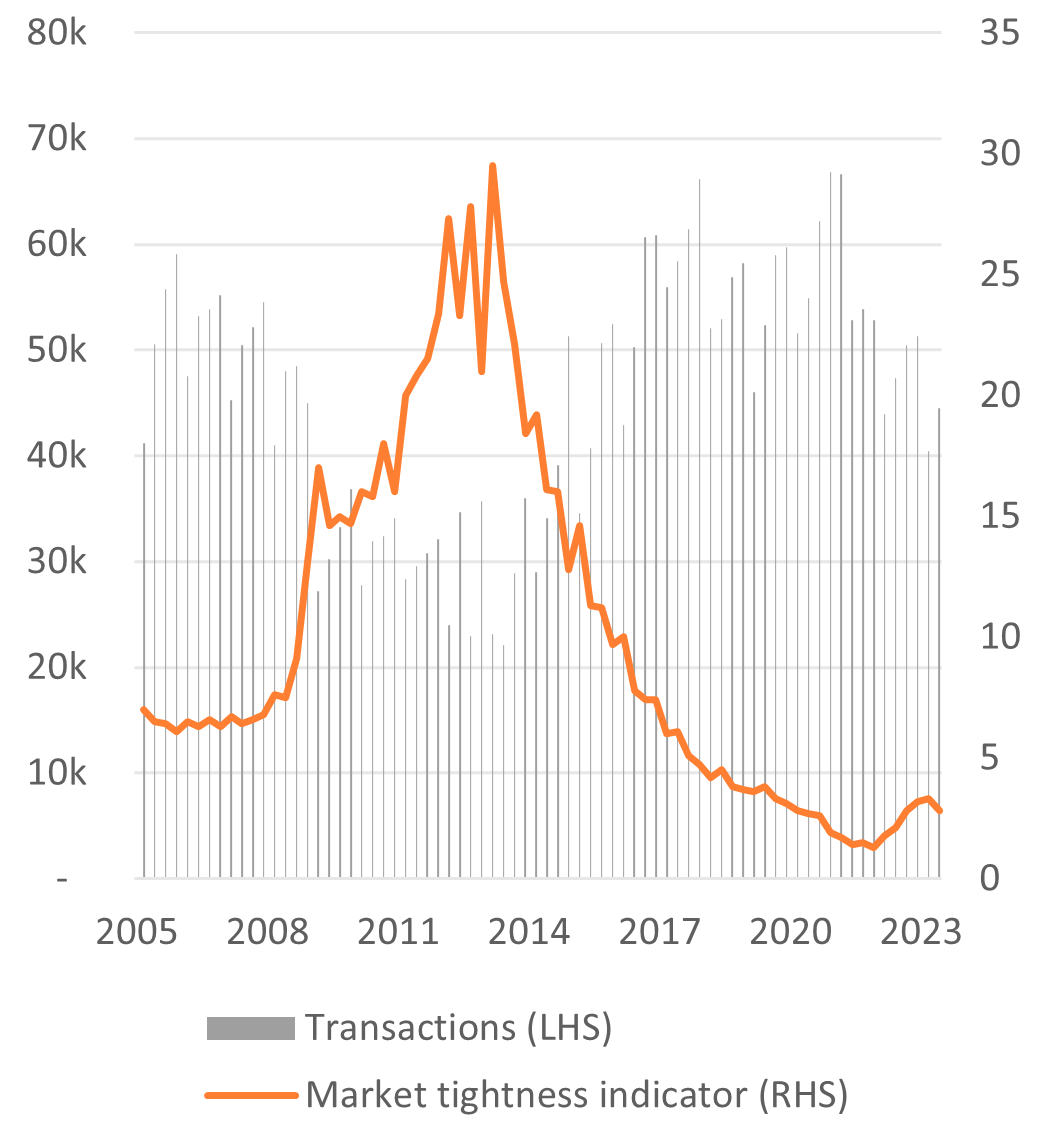

The housing market is showing mixed signals. The number of transactions rose by 10% QoQ to 45,000 in Q2 2023. However, the outlook for future transactions for both new and existing homes is far from favourable due to various issues hindering the construction sector. This could potentially limit the number of newly built homes and hence future transactions.

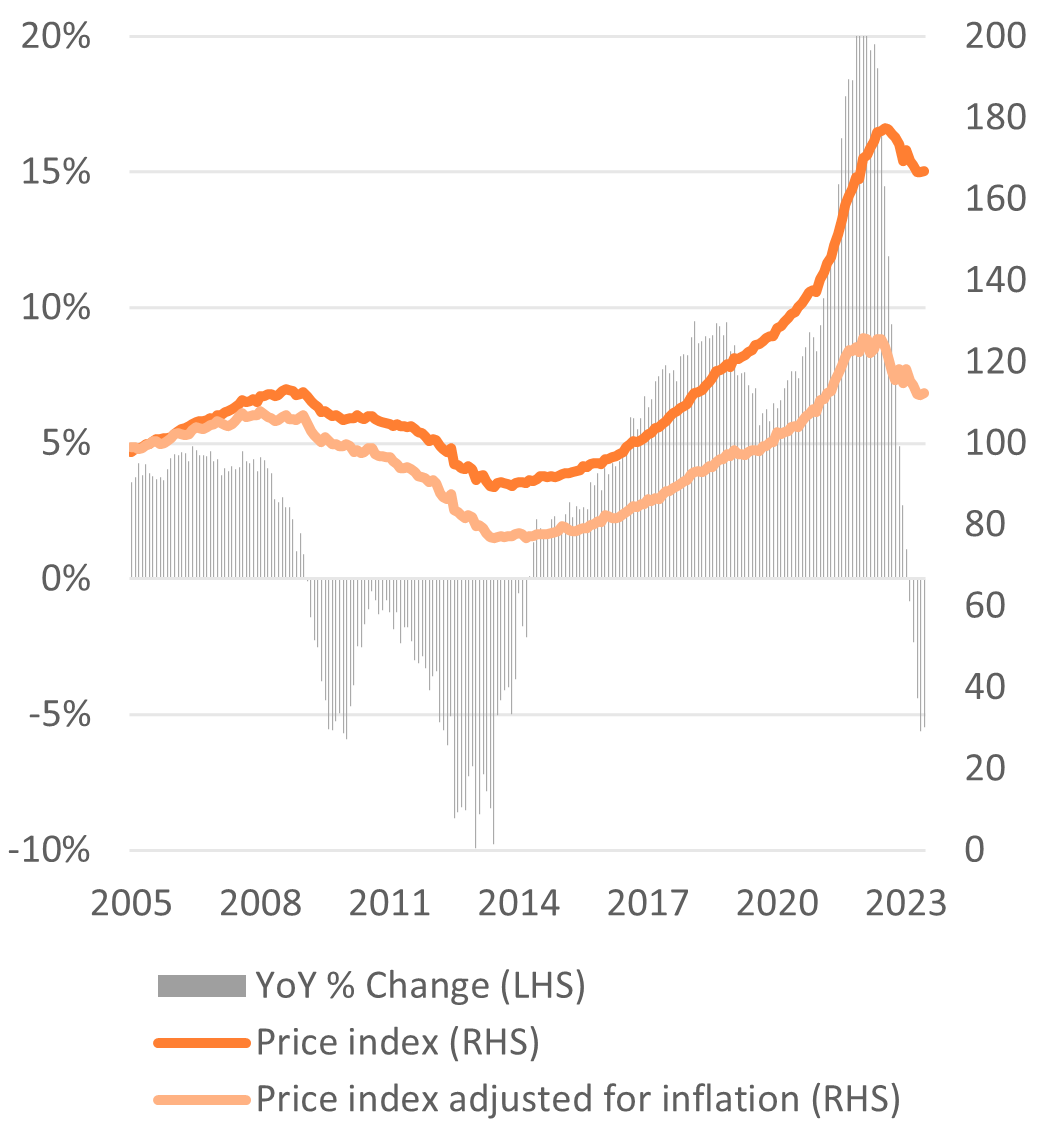

In Q2 2023, house prices fell by 1.9% QoQ, from an average price of 417,000 euros to 406,000 euros. The decline was mainly observed in the four largest cities and houses in the higher price segment. House prices remain uncertain but may rise again due to several factors. These include stable housing sentiment, stable mortgage interest rates, scarce supply of new houses, and higher wages.

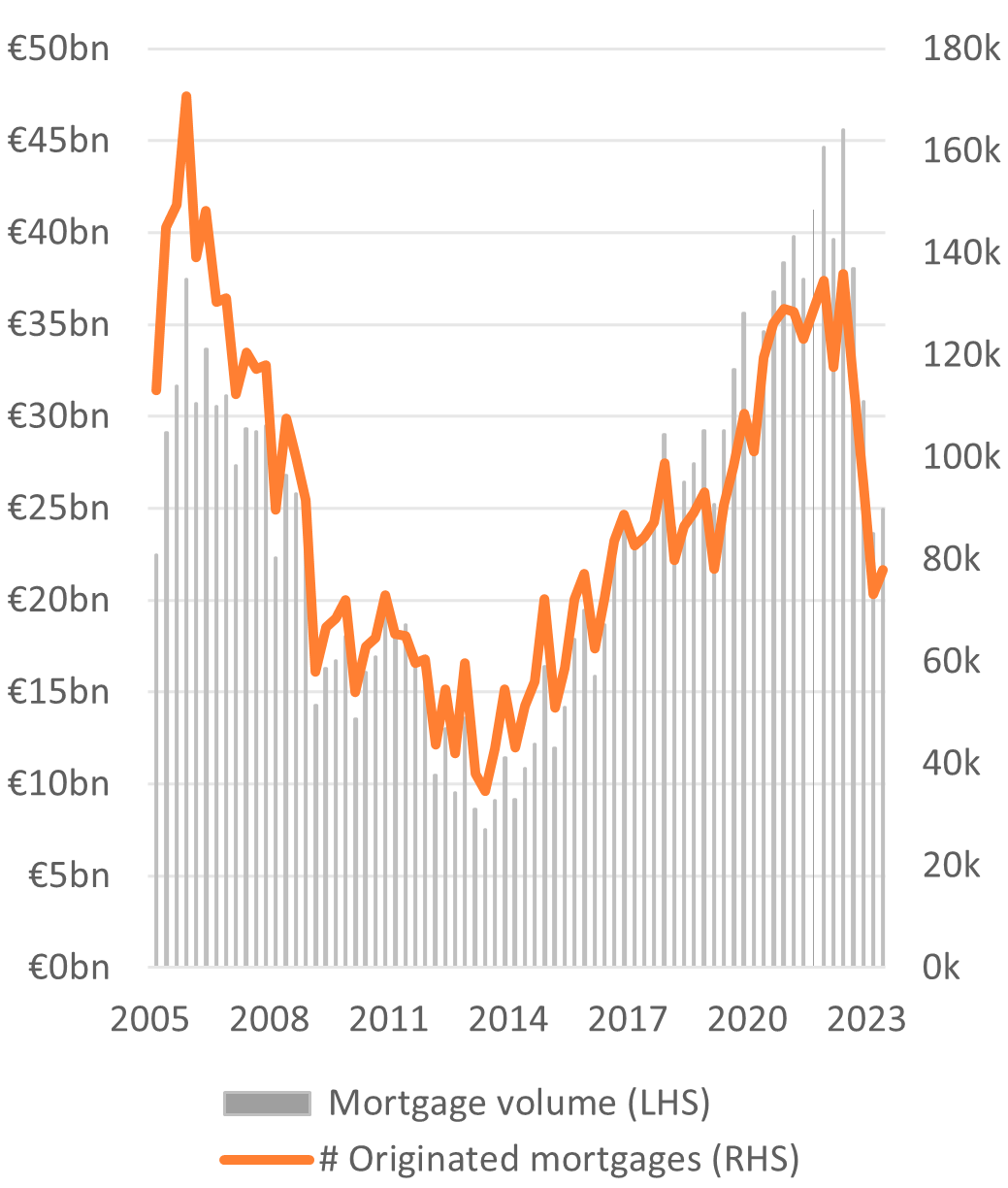

The number of mortgage applications has risen again, following the trend of more transactions. In Q2 2023, there were 93,000 mortgage applications, a slight increase of 1.8%. This was 9.2% higher than the recent low in December, when only 85,000 applications were recorded.

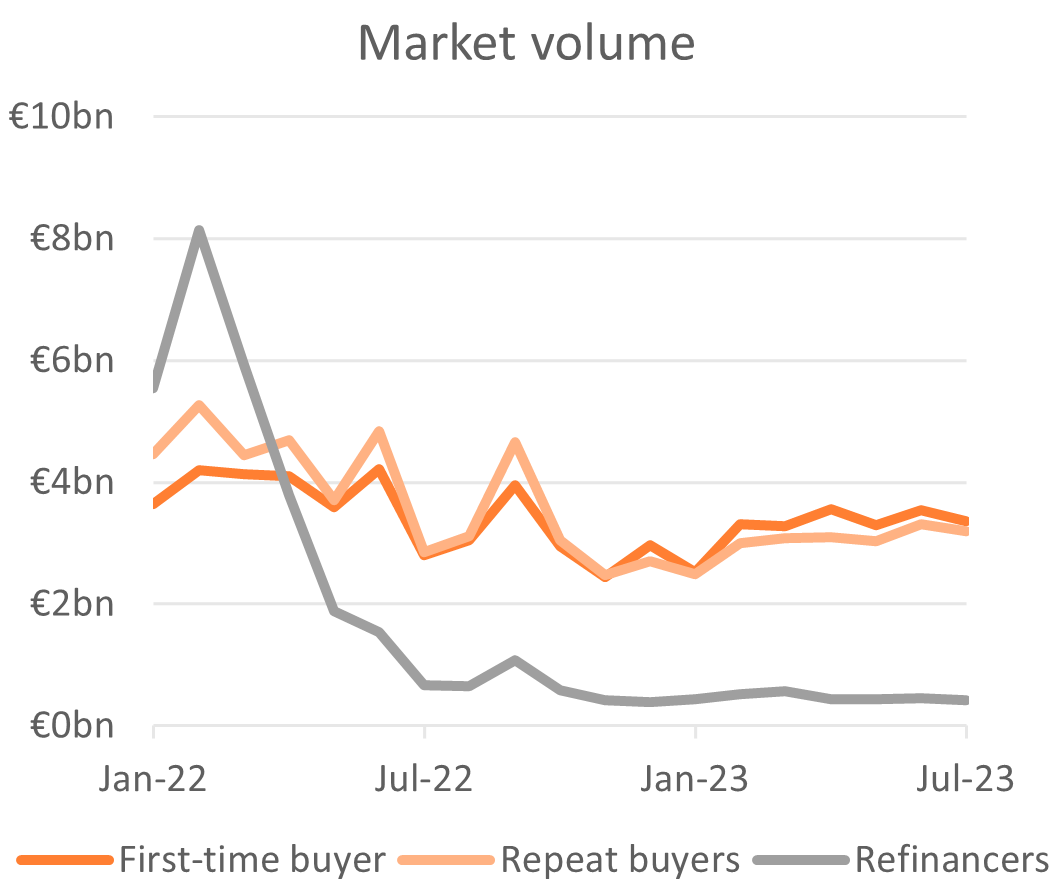

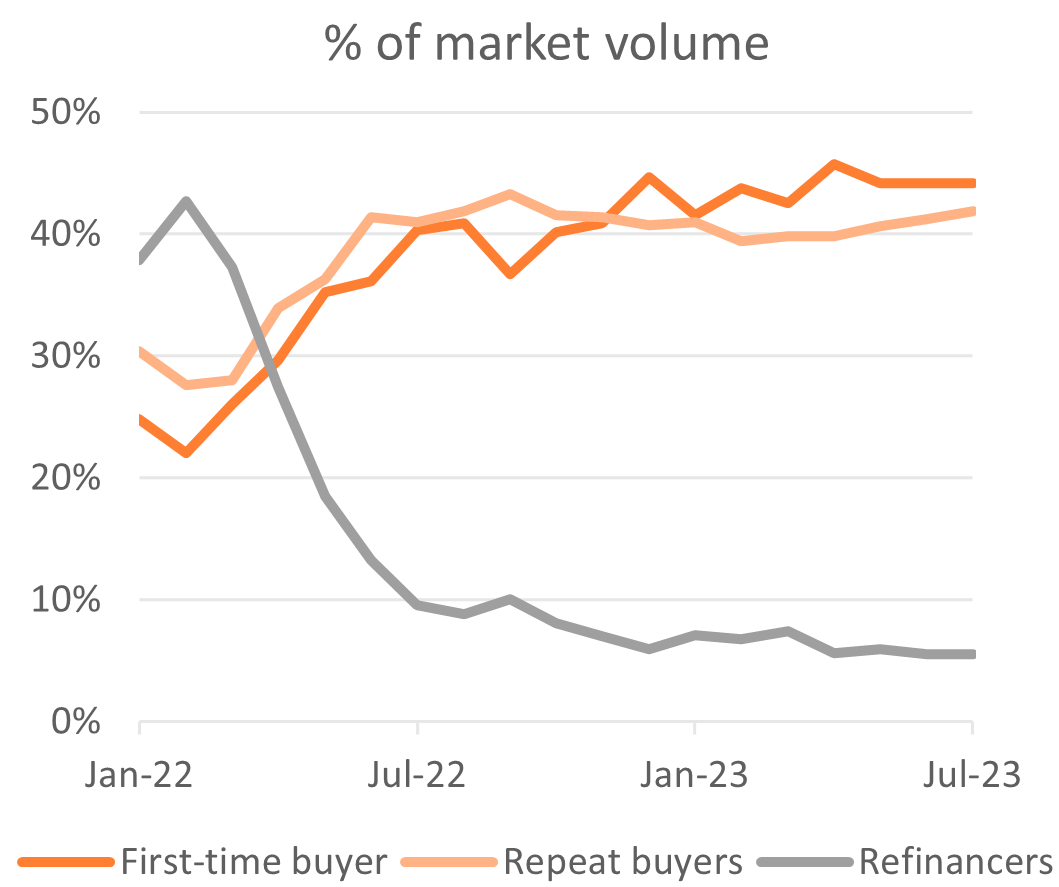

The upward trend in mortgage applications in the last two quarters resulted in the origination of a total of 78,000 mortgages (+6.4% QoQ and -43% YoY) with a total mortgage volume of 25 billion euros (+5.6% QoQ and -45% YoY). The Dutch Central Bank (DNB) confirmed this trend in its Bank Lending Survey, saying that the market is improving slightly.

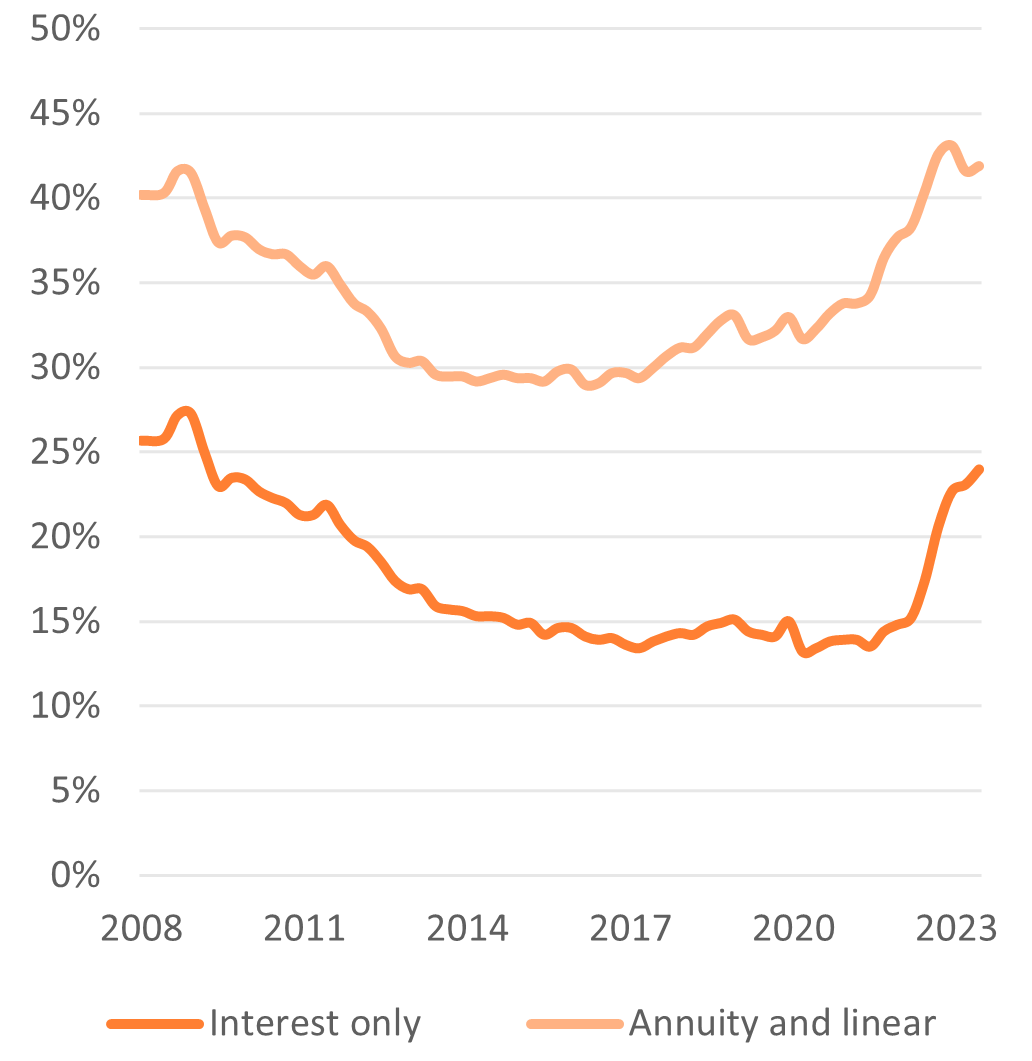

According to the Dutch mortgage network (HDN), first-time buyers are increasingly entering the market now that the situation has improved. This is due to two important regulatory changes early 2023, wages increased and declining competition from, for example, private investors. Furthermore, the Dutch central bank (DNB) reported that affordability in the Dutch housing market has improved.

While the macroeconomic environment contains warning signs of credit deterioration as a result of economic uncertainty and persistent inflation, Dutch residential mortgages continue to perform strongly and outperform other credit assets.

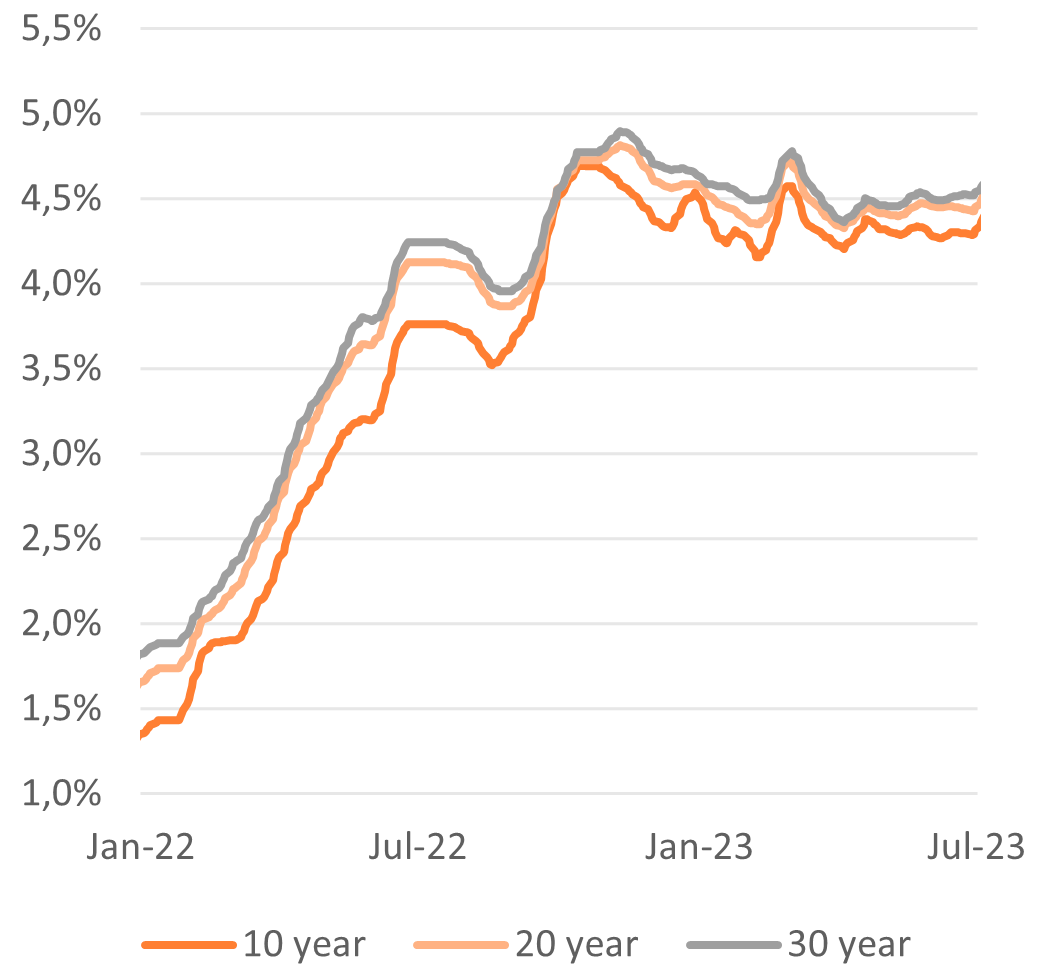

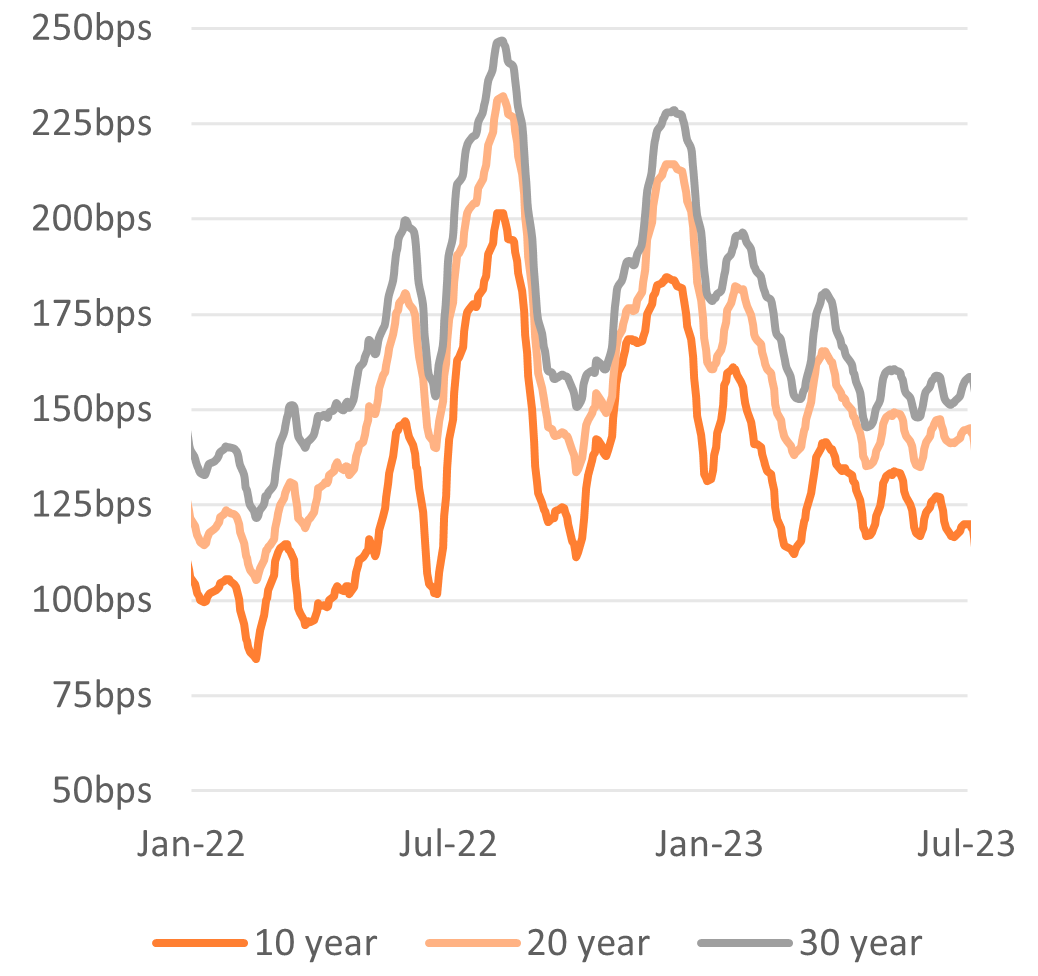

With mortgage origination volumes slowly picking up, both mortgage interest rates and spreads remain volatile. Notwithstanding the volatility, both mortgage interest rates and spreads stayed relatively stable compared to Q1 2023.

Economic indicators

Economies are increasingly affected by persistent inflation and high interest rates. In the Netherlands, lower household spending and a deterioration in exports led to a mild recession. Despite that, the labour market remains tight, and consumers are becoming more optimistic about the future.

Economics

After a contraction of 0.4% QoQ in Q1 2023, the economy experienced a further slowdown of 0.3% QoQ in Q2 2023, leaving the Dutch economy officially in a (mild) recession. However, when looking at the real economy (taking inflation into account), there has been a downward trend for some time now. On an annual basis, the economy also contracted by 0.3% YoY in Q2 2023. The deterioration in the economy is driven by lower household spending and exports, partly due to a deterioration in the German economy, the Netherlands' main trading partner.

With the Dutch economy slowing for the second quarter in a row, the Dutch economy is performing much worse than its neighbours. The economies of Belgium and France, for example, continued to grow (albeit modestly). The same applies to the eurozone economy as a whole. Only Germany is underperforming like the Netherlands.

The good performance of the economies in the Eurozone makes it more likely central bankers will be able to control inflation without disrupting growth. Making a ‘soft landing’ possible. At the same time, monetary policy takes time to work its way through the economy. In fact, some signs, such as weak demand in manufacturing, suggest that stress may arise in the coming quarters.

The European Central Bank maintained its contractionary monetary policy and raised its policy rates by 25bps in May and June1. The impact of the European Central Bank's policy is increasingly apparent in the credit standards and demand for corporate loans. The credit standards for these loans tightened further in Q2 2023, making the cumulated net tightening since the beginning of 2022 substantial. Also firms’ net demand for loans fell sharply.

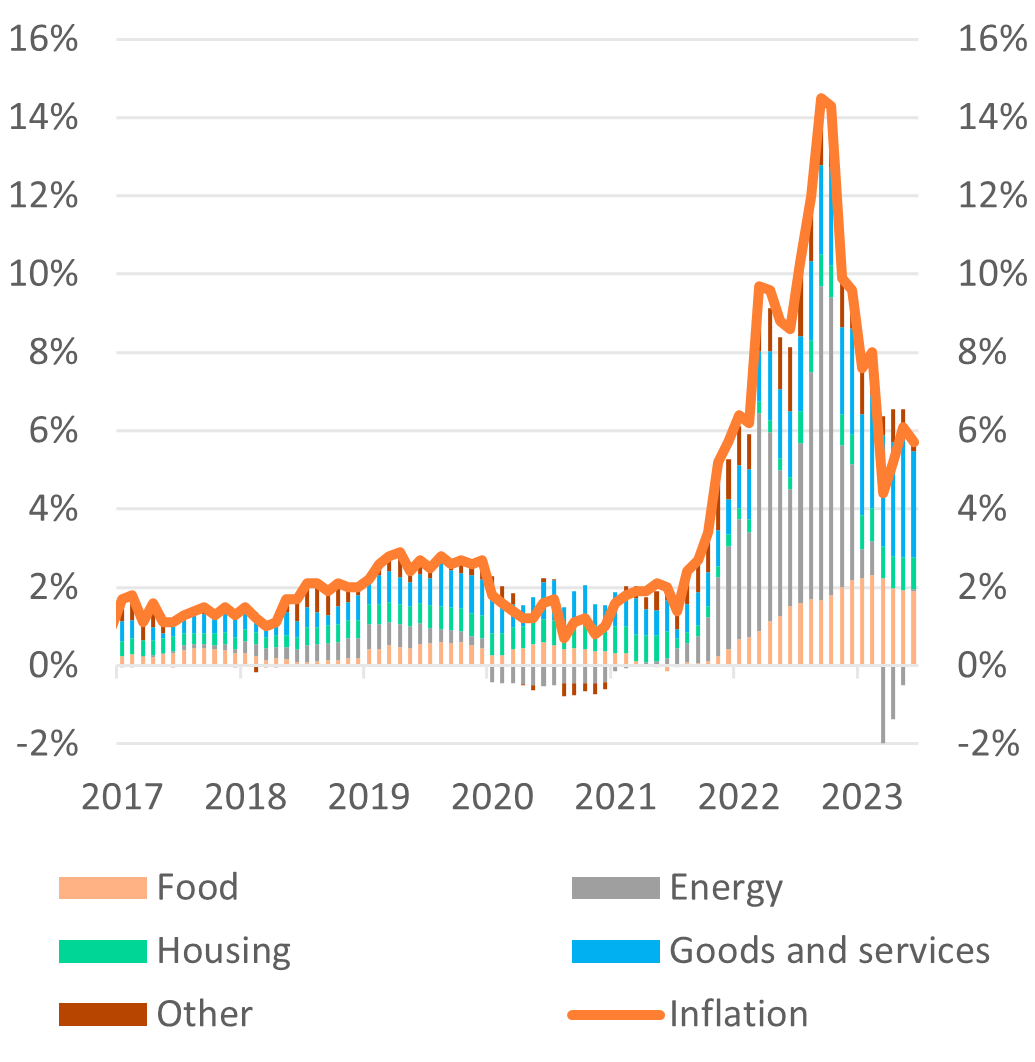

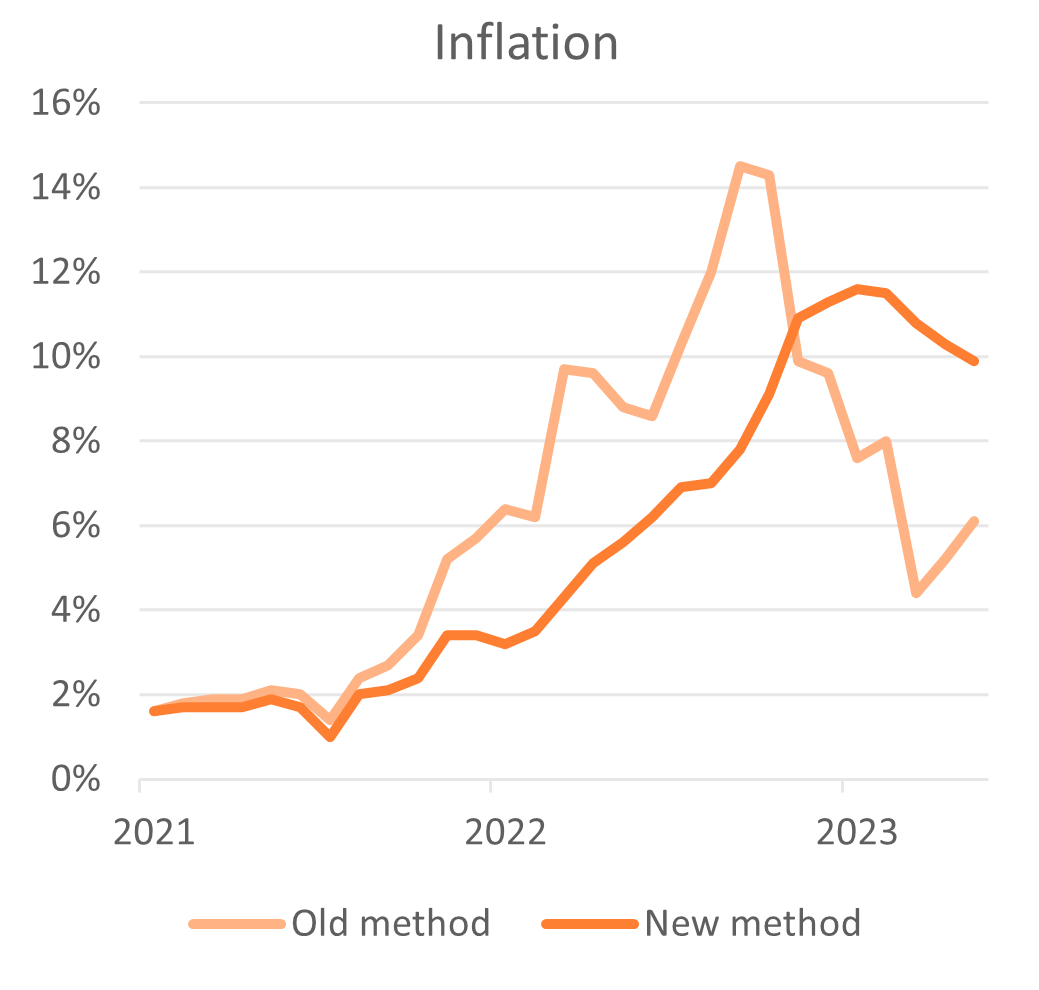

Inflation

Inflation2 in the Netherlands dropped slightly to 5.7% YoY3, in June 2023, from 6.1% YoY in May 2023. Lower energy prices (-19.1% YoY) mainly drove the small decline. However, this was largely offset by higher prices of groceries (+12.6% YoY) and food (+13.1% YoY).

The high prices of food and groceries are due to higher costs for producers and suppliers. This is because companies still feeling the impact of high energy prices from a year ago as many companies operate under long-term energy contracts and cannot adjust their prices quickly. Additionally, staffing costs, mainly wages, have increased significantly.

As wages has risen significantly, prices tend to increase too, making it one of the reasons why core inflation is likely to stay high.

Sentiment indicators

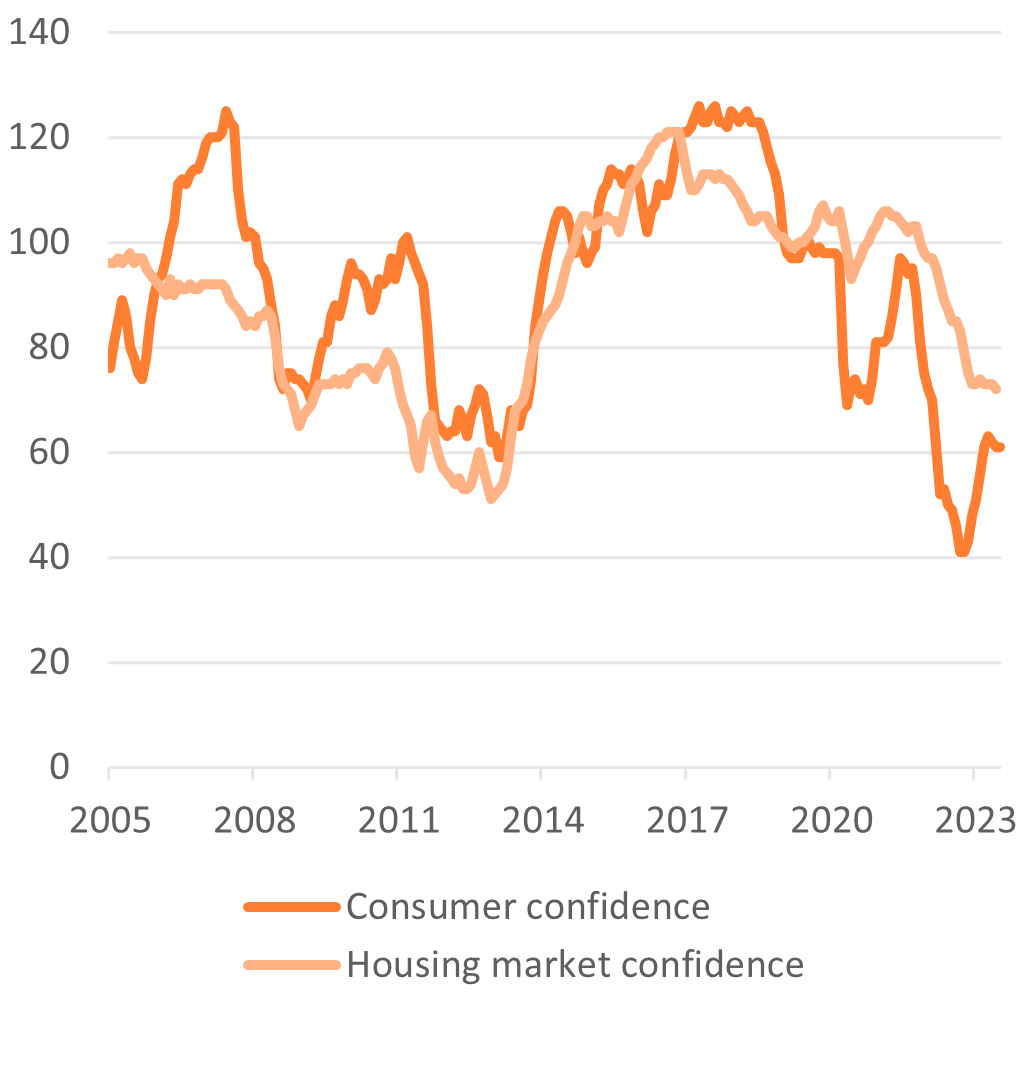

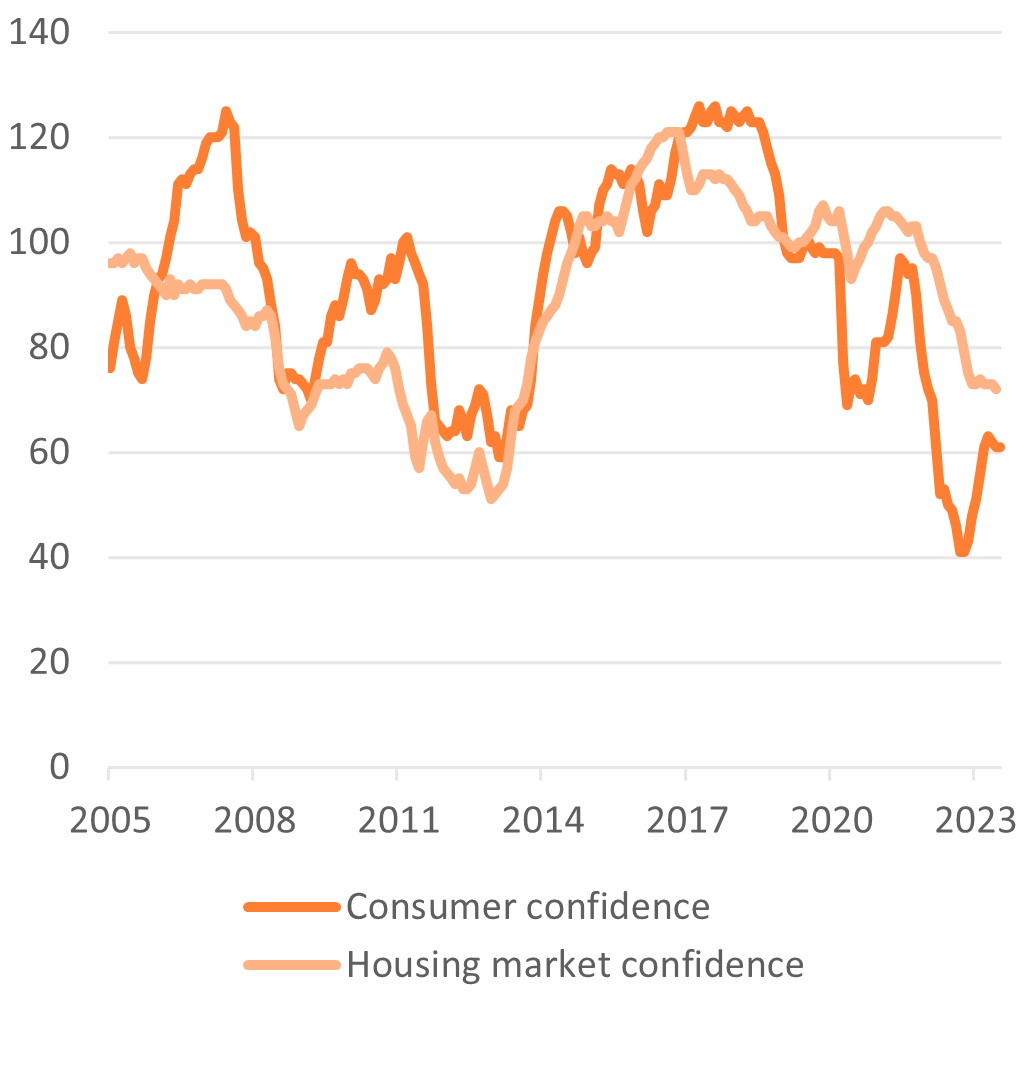

Overall consumer confidence4 fell to 61 at the end of Q2 2023 (-2-points QoQ), but improved on an annual basis (+11-points YoY). The overall level is based on economic sentiment, the propensity to buy, the economic and financial situation of households and whether it is a favorable time for major purchases.

While all indicators remain roughly the same as in the previous months, there is a clear improvement in almost all indicators compared to last year (apart from a favorable time to make major purchases).

Especially the view on the financial and economic situation for the next 12 months has improved significantly. The optimism about the future is probably due to less volatile interest rates, rising wages and falling inflation.

Confidence in the housing market4 fell slightly to 72 at the end of Q2 2023 (-1-points QoQ and -15points YoY). The negative housing sentiment continues to be driven by higher mortgage rates (reducing borrowing capacity), declining house prices and general economic conditions.

Even though market sentiment is still negative, the confidence indicator has stabilised. This is most likely due to the first signs of house prices stabilising. In addition, higher incomes are improving borrowers' affordability.