Sentiment indicators

Overall consumer confidence [3] continued to improve to 61 at the end of Q1 2023 (+13-points QoQ). The overall level is based on economic sentiment, the willingness to buy, the economic and financial situation of households and whether it is a favorable time for major purchases.

An important observation is that there is a strong improvement in all underlying factors with the exception of the indicator ‘favorable time for major purchases’. This suggest that households appear to be more cautious about making major purchases. Despite this, households have become more positive about the economic and financial situation over the next 12 months.

Confidence in the housing market2 remained stable at 73 at the end of Q1 2023. The negative housing sentiment is still mainly driven by higher mortgage rates (reducing borrowing capacity), declining house prices and general economic conditions. The negative sentiment is also affecting the market, as people may be anticipating future house price declines and therefore postponing their purchases.

Labour market

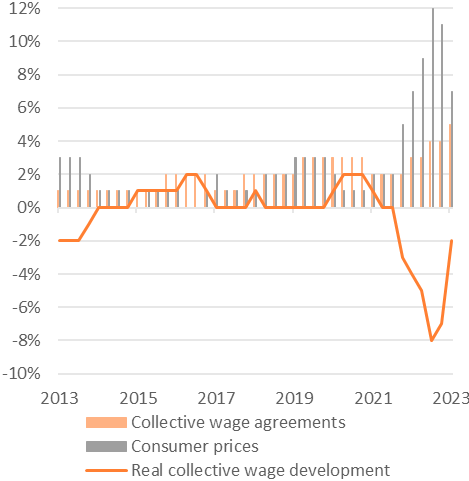

The improvement in consumer confidence can partly be explained by the historical wage growth in the recent period. The tight labour market also provides a high degree of job security, with an overall unemployment rate of only 3.6% in Q1 2023.

For employers, the tight labour market is an important reason to compensate employees for inflation, contributing to restoring the purchasing power of households.

The Dutch Central Bureau of Statistics (CBS) reports that wage settlements experienced a substantial increase of 5% in Q1 of 2023, which is nearly twice the rate recorded a year ago (2.7%). This marks the largest increase in wage settlements in the past 40 years. In March 2023, data from the Dutch employers' association (AWVN [4]), indicate wage settlements even surged by 7.5%, surpassing inflation for the first time in a prolonged period.

Housing market

The number of transactions and the willingness to overbid in the Dutch housing market continue to decline. As a result, house prices have fallen for the second consecutive quarter. While buyers and sellers are increasingly driven by uncertainty, financial conditions and mortgage affordability appear to have improved in recent months.

For employers, the tight labour market is an important reason to compensate employees for inflation, thereby helping to restore household purchasing power.

The Dutch Central Bureau of Statistics reports that wage settlements experienced a substantial increase of 5% in Q1 of 2023, which is nearly twice the rate recorded a year ago (2.7%). This marks the largest increase in wage settlements in the last 40 years. In March 2023, data from the Dutch employers' association (AWVN) [1], indicated that wage settlements rose by 7.5%, outpacing inflation for the first time in a prolonged period.

The significant increase in wages is beneficial for employees but must be approached carefully as it could potentially trigger a wage-price spiral. DNB notes that increased wages and resulting higher labour costs are already contributing to higher prices. The impact is currently limited, and there are no indications of a wage-price spiral yet. However, the DNB warns that this may change if wage settlements continue to increase, reaching levels of 7% to 10%.

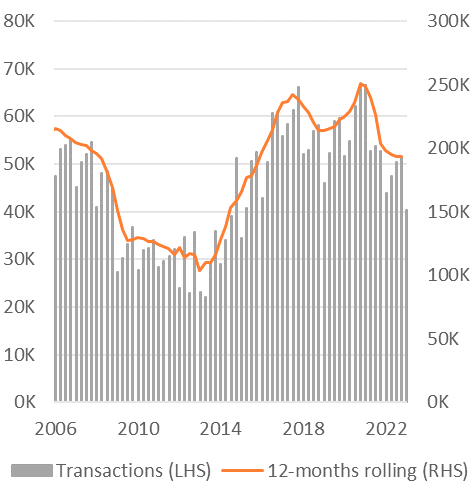

Transaction volume and housing supply

In Q1 2023, the number of transactions fell to 40,000, a decrease of 21% QoQ. On an annual basis, the number of transactions fell by 8%.

According to the Dutch Association of Real Estate Agents (NVM), the number of houses for sale gradually increased to almost 35,000 at the end of 2022, after reaching an all-time low of 15,500 houses for sale at the end of 2021. In the last quarter, however, the number of houses for sale fell back to 31,000 (-9% QoQ).

The current state of the supply and demand dynamics can be explained by the market tightness indicator, which measures the ratio of the current number of houses for sale (supply) to transactions (demand). The ratio improved slightly to 3.3 (+0.1-points QoQ) in Q1 2023, indicating that prospective buyers have an average of 3.3 houses on offer to choose from.

Recently, the Dutch government introduced a new policy [5] on rental housing. Investors in rental housing, such as private individuals, argue that the new plans will make their investments unprofitable and threaten to sell their rental properties en masse. A potential sale of these houses could be beneficial to the housing market, but it remains to be seen whether these houses will meet current demand.

New construction and housing shortage

The promising news of last year, with a record-breaking 75,000 newly constructed homes, has swiftly been reversed at the start of 2023. With less than 7,000 permits issued and only 10,000 new homes built in the initial two months of this year, it is likely that the construction of new homes will decline further. This is particularly obvious when taking into account the declining number of permits issued at the end of 2022.

Another concerning factor is the stagnation in sales of (affordable) new homes due to reduced interest from buyers. The lack of interest is mainly due to an increased price differential between new-build homes and comparable existing ones. While prices of existing homes are falling, new-build homes have to be sold for a certain amount to cover the expenses of construction (such as building materials and labor), making it more difficult to price them competitively.

The diminishing interest in new-build homes is also evident from the data. According to the NVM, only 5,925 newly built houses and plots were sold in Q1 2023, marking the lowest figure since records began in 2013.

The problem of declining interest is not the only challenge for (affordable) new-build homes. Rising construction costs and higher interest rates are also making new construction projects financially less viable, resulting in developers deferring projects. Thousands of planned new homes are not constructed at all due to the limited number of buyers. Developers are also withdrawing homes from sale. Last year, 4,694 planned new homes were withdrawn from sale due to the lack of interest. In Q1 2023 alone, over 1,900 new-build homes were taken off the market for this reason.

House prices

After eight years of growth, Dutch house prices fell by the end of 2022 on an annual basis. According to the Land Registry, the house price index fell by 1.6% QoQ in Q1 2023 [6](and -0.7% YoY). The decline in house prices recorded by the Land Registry is in line with the downward trend published earlier by the NVM (-0.6% QoQ in Q4 2022 and -3.6% QoQ in Q1 2023 [7]). The downward trend is especially visible in the four largest cities (Amsterdam, Rotterdam, Utrecht and The Hague), while houses in other parts of the country are currently less affected.

In nominal terms, house prices fell by 2.3% YoY in Q1 2023 from 426,000 euros to 417,000 euros. Comparing the current average nominal value with the peak in August 2022 (446,000 euros), prices have already fallen by 7%, marking a significant decline in nominal house prices in recent months. Moreover, for the first time in 4 years, the average price paid was slightly below the asking price. The fall in house prices is currently leading to a more accessible market, particularly for first-time buyers.

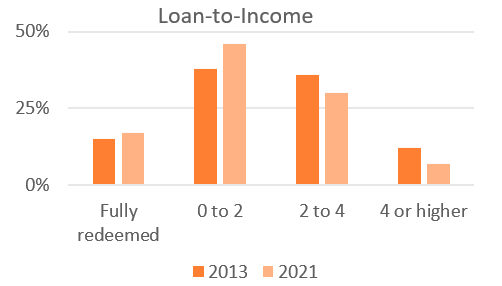

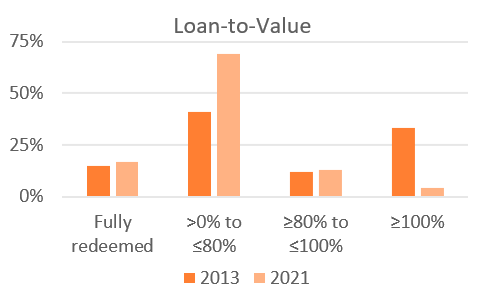

At this point in time and at this pace, the fall in house prices does not pose a major risk because the Dutch housing market is currently in good shape. Households continue to redeem their mortgage, credit conditions are conservative and many people have fixed interest rates for longer periods making them less vulnerable to interest developments. The solid state of the Dutch housing market is also evident when comparing loan-to-income (LtI) and loan-to-value (LtV) ratios for 2021 with 2013.

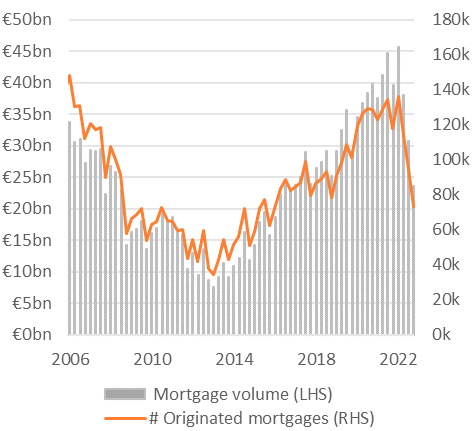

The overall decline in the number of mortgage applications is increasingly reflected in the market volume. In Q1 2023, the number of originated mortgages fell to 73,000 (-23% QoQ and -38% YoY) and the mortgage volume fell to 24 billion euros (-23% QoQ and -40% YoY).